JOE BASRALIAN AND THE WINIFRED M.AND GEORGE P. PITKIN FOUNDATION

JOE BASRALIAN AND THE WINIFRED M.AND GEORGE P. PITKIN FOUNDATION Read More »

On May 9, Republicans on the House Ways and Means Committee released the first wave of their tax proposals as part of the overall budget reconciliation process. The Committee has scheduled a markup of tax reconciliation measures for May 13. As this is just the opening salvo, we expect new proposals, changes, and constant updates until the President signs a final bill.

Other important proposals that you will find of interest are:

Winne Banta Basralian and Kahn recommends that you schedule a meeting with one of the attorneys in our Tax, Trusts and Estates Department, which will allow you and your family to consider and finalize the most comprehensive and effective estate plan that fits your specific needs and goals. Do not overlook and forgo the value of the extra gifting power available to you while the exemption remains at a historical high.

Co-Chairs of the Tax, Trusts & Estates Department:

Martin J. Dever, Jr. mdever@winnebanta.com

Jonathan Kukin jkukin@winnebanta.com

Partners of the Tax, Trusts & Estate Department:

Arthur I. Goldberg agoldberg@winnebanta.com

Peter J. Bakarich, Jr. pbakarich@winnebanta.com

Doris Brandstatter dbrandstatter@winnebanta.com

Associates of the Tax, Trusts & Estate Department:

Marley A. Guerrera mguerrera@winnebanta.com

Sara E. N. Lerner slerner@winnebanta.com

On October 29, 2024, the Essex County Bar Association honored our partner, Kenneth Lehn, and others for 50 years of practice. A video taped interview with him and about him with our senior managing partner, Joseph Basralian, and retired chancery judge, Harriet F. Klein, is posted here. The Bergen County Bar Association similarly honored Ken and other 50 year practitioners on October 22.

Kenneth Lehn Honored By Essex County Bar Association Read More »

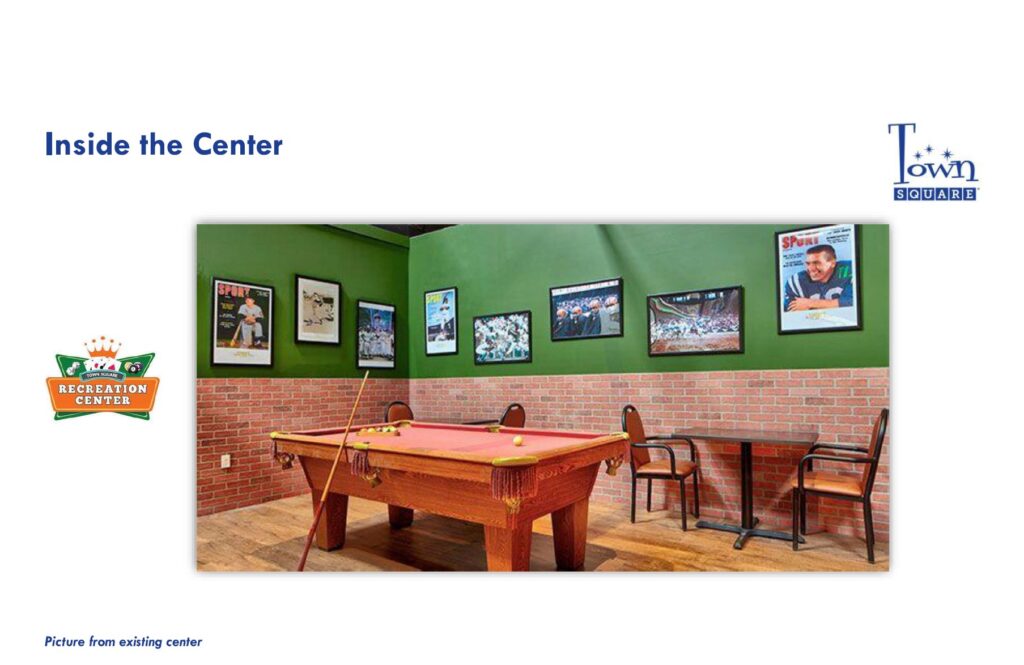

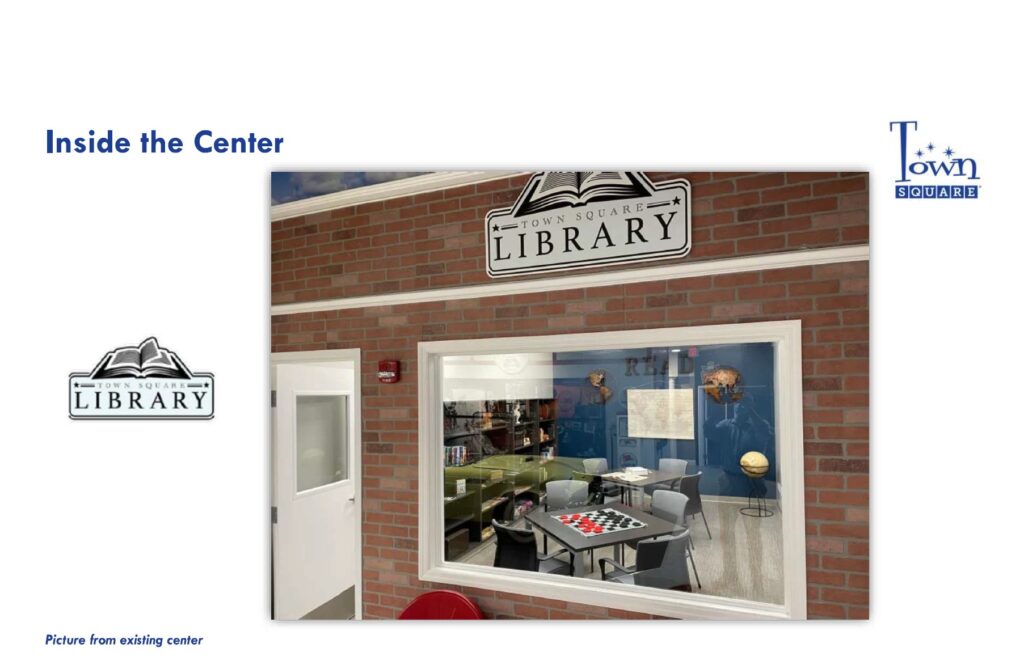

Bruce Rosenberg has recently secured use variance approval for a Town Square Adult Medical Day Care from the Fair Lawn Zoning Board of Adjustment.

This will be the first Town Square to be located in Bergen County. Town Square provides a unique re-creation of a 1950’s type Town Square in which Reminiscence Therapy is used to treat members with memory loss issues.

Bruce Rosenberg Secures variance approval from the Fair Lawn Zoning Board of Adjustment Read More »

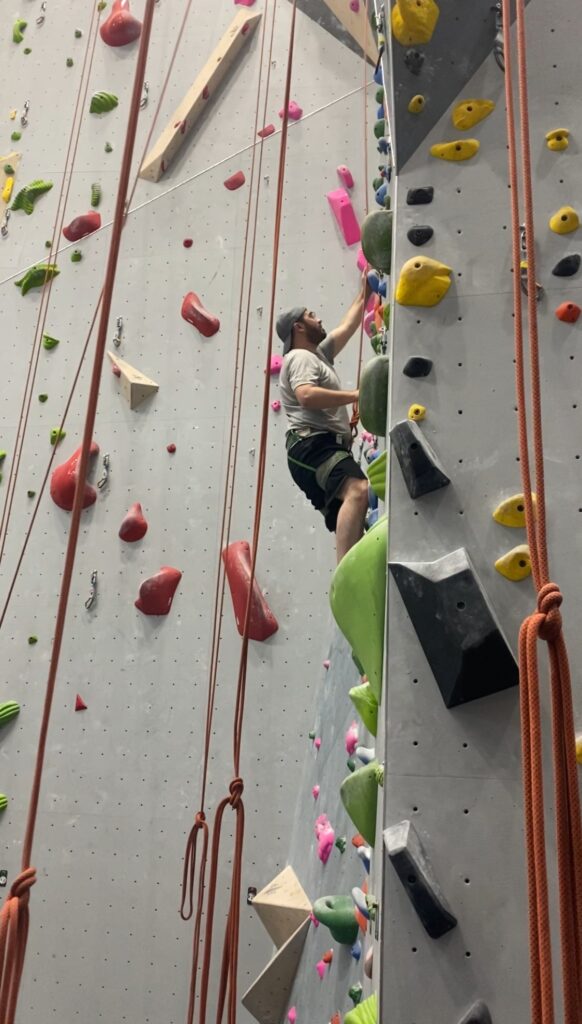

The Winne Banta team never backs down from a challenge – even if that means climbing a 40ft wall!

Associates and interns from various departments – Tax, Trusts and Estates; Litigation; and Real Estate – learned the basics of climbing, bouldering, and falling (safely) from the wonderful staff at GOAT Climbing Gym (“GOAT”). GOAT, located on River Road in Hackensack, New Jersey is a community-focused climbing gym featuring 60ft competition walls, 40-60ft top rope climbs, and bouldering walls. It’s a fun and challenging environment and the Winne Banta team enjoyed the opportunity to support a local business, learn a new skill, and overcome the fear of heights (the floor does look quite far away from 40 ft up!). Altogether, the experience was an exercise of perseverance and strategic thinking, the same skills used by the Winne Banta team in their legal practice. They’re simply thankful to do so from the ground.

Winne Banta Associates Climb to New Heights Read More »

Dennis Harraka and Bogdan Kachur secured a $3 million settlement against the City of Englewood, two of its police officers and a local restaurant. The police allowed an obviously drunk driver to leave the scene, without arresting him, after stopping him for a minor traffic offense. The driver had been drinking all evening including the previous 3-4 hours at the restaurant, the El Tango Grill, which was only minutes from where the stop occurred. Within 20 minutes of releasing him, the driver rear-ended our client, Vladimir Diaz, on Route 4 in Paramus. Mr. Diaz suffered various injuries, spent 17 days in a coma and has been left with brain damage and other permanent conditions.

Dennis Harraka and Bogdan Kachur secure $3 Million Dollar Settlement Read More »

Congratulations to the Winne Banta attorneys who have been selected for inclusion in the 2024 edition of New Jersey Super Lawyers and Rising Stars, published by Thomson Reuters. Super Lawyers recognizes outstanding attorneys who have attained a high-degree of peer recognition and professional achievement. Super Lawyers recognize no more than 5% of New Jersey attorneys and only 2.5% of New Jersey attorneys receive a Rising Star distinction.

Winne Banta is pleased that Principals Peter J. Bakarich, Jr. (left, in photo) and Kenneth Lehn (center) have been included on the list of 2024 Super Lawyers. Associate Bogdan Kachur (right) has been included on the list of 2024 New Jersey Super Lawyers Rising Stars.

2024 edition of New Jersey Super Lawyers and Rising Stars Read More »

An article by Winne Banta Basralian & Kahn’s Jonathan Kukin and Marley Guerrara, “Estate Planning for 2024 and Beyond: Time Is Running Out! Plan Now for Your Family’s Future” was published recently in The New Jersey Law Journal. In the article, Jonathan and Marley noted, “There are less than two years to take advantage of the highest federal estate and gift tax exemption of all time. Are you prepared to capitalize on the unprecedented opportunity for tax planning prior to the ‘sunset’?”